Years ago, when Bill Gates was the world’s wealthiest person by a significant margin, he visited Israel. Gates held a wide-ranging news conference, and as one would expect, one of the questions was about money and particularly suited to him. The question: Does money create happiness? Gates answered without blinking an eye. “Absolutely not,” he said.

Many people respect Gates’s opinions; nevertheless, they still want to be rich. They fantasize about wealth, pray for it, and sometimes make very risky investments in the hope that one will pay off big time.

On the bottom line, wealth has drawbacks, as it often generates jealousy, arguments, deceit, and theft. At best it’s fleeting, and at worst destructive. But that doesn’t stop people from dreaming.

If it were possible to speak directly with the super-rich we would certainly gain lots more insights into this subject. They know how it feels to become incredibly wealthy; many of them also know what it feels like to lose billions of dollars – sometimes in a few weeks or even in a few days.

Given the market’s huge declines, even ordinary John and Jane investors have come to understand this feeling. According to Bank of America, an incredible $46.1 trillion in wealth has been vaporized from global stock and bond markets since November 2021; market commentators say this is a worldwide decline of historic proportions. These losses will certainly be discussed and analyzed for decades. Meanwhile, countless investors have to decide whether to sell and salvage whatever is left of their portfolios or risk further losses in the hope the market will rebound and they’ll be able to recoup at least some of their losses.

Sharing The Pain

2022 as a whole has been a tough year for the market, but September in particular has been difficult. For example, on September 13, the market dropped 1200 points, the worst one day drop since June 2020. As anyone who follows the markets knows too well, the pain was not limited to just a few days.

To give an idea of how bad the selling was, consider this: Virtually all classes of assets were affected - stocks, bonds, interest rates, cryptos, and even housing. Gold and silver also dropped. Even many stocks considered safe because of their high dividends or because their businesses are defensive also fell sharply.

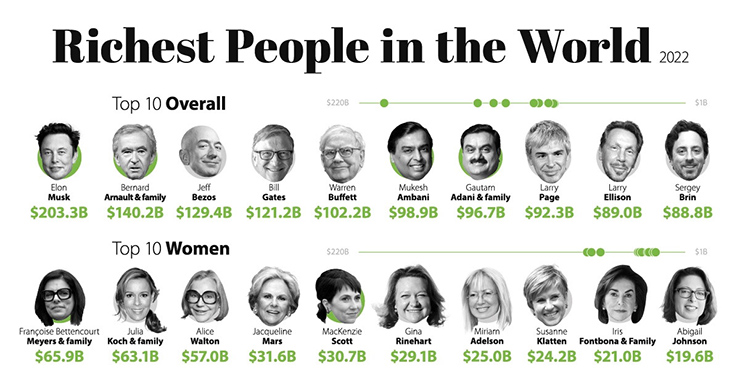

Not only did the ultra-rich not escape the carnage, but some of them led the pack. According to Bloomberg’s Billionaire Index, the world’s five richest billionaires lost a combined total of $25 billion of their wealth in just a few weeks.

Jeff Bezos topped this list of billionaire losers; his vast fortune became noticeably less vast as it shed $9.8 billion. In second place was Elon Musk, who lost only slightly less; Musk’s net worth declined by $8.4 billion.

During this time frame, other famously rich also took it on the chin. They include Bill Gates, who lost $2.84 billion, and Warren Buffett, whose net worth sunk by $3.36 billion.

More Than Half

According to Bloomberg, “The world’s 500 richest people have lost a combined $1.2 trillion since January 2022.”

Possibly the biggest loser was META (aka Facebook) CEO Mark Zuckerberg, who lost a whopping $68.3 billion; META is pouring a fortune into development of new technology and at the same time wrestling with slowing growth and related problems in its core social media business. META’s shares were recently trading at $134, down from $379 just over a year ago. Only four stocks in the S&P 500 have done worse.

These losses were enough to push the “Zuck’s” ranking as the world’s 3rd wealthiest person down to 20th place – certainly nothing to be ashamed of but still not as spectacular as it was just a few months before. Will META be able to reverse its decline? That remains to be seen. In any case, Zuckerberg is not alone as numerous other mega rich also took major hits to their net worth, the Washington Examiner reports.

A Few Billion Here And There

The latest Forbes list of the richest people in the world shows some interesting changes from last year’s list. It has 2,668 names, which is down 87 from the year before. In total, they’re worth an estimated $12.7 trillion, down $400 billion from a year ago.

As one might guess, Russia and China lead the list of countries with fewer billionaires than a year ago; the number of Russian billionaires declined by 34 as a result of the war with Ukraine and its consequences. In China, the number the number of billionaires fell by 87, in large part because of a government crackdown on tech companies.

Despite the growing tensions in the world and extreme volatility in the market, Forbes reports that “there are more than 1,000 billionaires who are richer than they were a year ago,” a very surprising finding. 236 are newcomers to this exclusive club this year, with at least one from Barbados, Bulgaria, Estonia, and Uruguay.

America can still boast of having the most billionaires with 735, and they are worth a combined $7.4 trillion (some numbers will likely have changed by the time you read this because of the continuing selloff on Wall Street). This year, Elon Musk tops the list for the first time.

Just possibly, there’s an overlap between sports fans watching their favorite team stuck in a losing streak and the relentless losses in the market. Sports fans console themselves by trying to be optimistic, saying the team is overdue for a win. Maybe the same is true of investing, and after all, the losses stocks are due for a rally.

This is an encouraging thought. But what would be even better is if a strong rally actually materializes.

Sources: www.bloomberg.com; www.cnbc.com; www.entrepreneur.com; www.forbes.com; www.fortune.com; www.washingtonexaminer.com

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.