Driving a cab is high-pressure work. Then why does anyone do it? One driver gave this answer: “I leave every morning with empty pockets and come back with a wallet full of money.” Others expressed a similar sentiment. After driving a taxi for a few years, people from all kinds of backgrounds were able to save enough to make a down payment on a house or to start a small business. Either way, they enjoyed a taste of the American dream.

But these days taxi drivers are trying to cope with a problem much worse than rude passengers and relentless traffic jams. They are desperately trying to stay afloat, and a growing number are losing the battle.

I Owe, I Owe, Off To Work I Go

The plight of many taxi drivers has become unbearable since they took huge loans to buy a medallion, a permit that allows them to drive a yellow cab.

Medallions have several benefits: they make passengers feel safe when they enter a cab and also give them confidence that the driver will not take them on a long, circuitous trip when all they want is to go a few blocks. They have also proven to be good investments, as the price kept increasing steadily.

Would-be taxi drivers, many of them immigrants, have gone deeply into debt to purchase medallions because of their money-making potential: Typically, drivers who own them would be able to earn $5,000 a month, but in some cases much more.

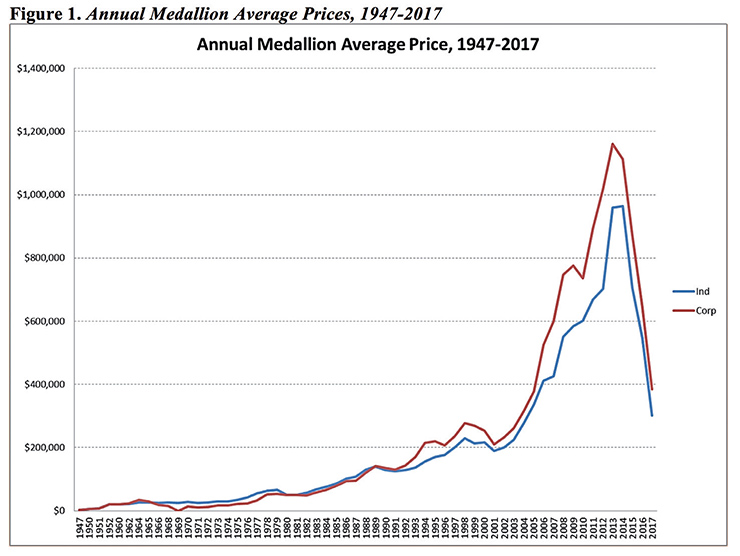

By 2010 the price of a medallion had jumped to $700,000, up from $200,000 just a few years earlier. Both city and state officials who studied the industry warned that cabbies were taking on too much debt and that the market price of medallions was rising too quickly and would collapse. Nevertheless, no one took action to regulate or control the price, and by 2014 its cost had skyrocketed to nearly $1.4 million.

Bubble, Bubble, Toil And Trouble

At that point it was obvious that a huge bubble had formed. As is the case with all bubbles, this one ultimately burst and the price of a medallion began dropping precipitously. By that point, however, drivers who had purchased them had accumulated so much debt that nearly all of their earnings went toward making payments on loans. Of the typical $5,000 they made in a month, $4,500 went toward loan repayment, which means they couldn’t afford their rent, food, utilities, and other essentials.

The stress of driving, combined with the financial pressure of trying to make regular payments on their loans, became overwhelming. According to a lengthy study by The New York Times, 950 medallion owners have filed for bankruptcy, and thousands more are on the verge of financial ruin. Many drivers lost their life savings and at least eight have committed suicide.

In the last six years, the price of a medallion has dropped by more than half. According to CBS News, in 2017 at least one taxi medallion in New York sold for as low as $241,000, well over a million dollars below its high. And with all the added competition from related services like Uber and Lyft, it’s unlikely that the price of a medallion will go back to its former high any time soon.

According to The Times, despite years of warning signs, at least seven government agencies have done little to prevent a collapse in the price of medallions. The agencies that were supposed to police the industry ignored the signs that a dangerous bubble was forming.

“[The drivers] were conned,” concluded The Times. “Bankers devastated thousands of New York City taxi medallion owners.” In fact, industry leaders drove up prices even further.

“In the last 12 years, thousands of foreigners poured their life savings into shady loans and had hundreds of millions of dollars extracted from them by financial institutions. Bankers, brokers, lawyers, investors, fleet owners, and debt collectors generated huge profits from these business practices. These people became multimillionaires, Wall Street cheered, and medallion brokers bought yachts and waterfront properties.”

Meanwhile, the city’s Taxi and Limousine Commission, which was supposed to regulate the industry, was promoting medallions, declaring that they were a “better investment than the stock market.”

The city raked in many hundreds of millions of dollars by selling medallions, generating much-needed revenues that helped them balance budgets and fund priorities, all on the backs of cabbies. By the way, many other cities have also raised significant amounts of revenues by selling high-priced taxi medallions.

You, Me, And The Cab Driver

At first glance, it may seem like the financial woes of mostly immigrant cab drivers has nothing to do with ordinary investors. Actually, it does. In fact, The Times noted that lending practices for cab drivers were as fraudulent as the subprime mortgage industry in 2007.

And that’s just the beginning of the overlap between them. In both, some industry leaders enriched themselves by artificially inflating prices. They encouraged buyers to borrow as much as possible and misled them to take loans requiring hefty fees, forfeiting their legal rights and giving up most of their monthly incomes.

Moreover, when the medallion market collapsed, “the government largely abandoned the drivers who bore the brunt of the crisis,” continues The Times. “Officials did not bail out borrowers or persuade banks to soften loan terms.”

“The whole thing was like a Ponzi scheme because it totally depended on the value going up,” said Haywood Miller, a debt specialist who has consulted for both borrowers and lenders. A lot of homeowners understand exactly what cabbies are going through now.

So do many investors who got trapped in a bubble. In late 1999 and early 2000, dot com and other stocks soared before one of the most painful declines on Wall Street in decades. Stocks also rallied in a huge bubble in 2007-08, but subsequently withered as the bull market gave way to The Great Recession.

More recently, Bitcoin took the market by storm. In the space of only a few years this crypto currency appreciated by many thousands of percent. Starting at only a few cents, in Dec. 2017 it topped out at $20,000, having formed probably the biggest bubble in market history. However, since then the price has deflated drastically.

Some veteran market watchers warn that a bubble has formed in bonds, and many more say an even bigger bubble has formed once again on Wall Street. And over the years there have been countless bubbles in both high quality and very speculative stocks.

Small investors often get burned. They have an urge to invest but wait on the sidelines; meanwhile, stock prices soar, and their hesitations are gradually worn down. They berate themselves because in a matter of weeks they could have made substantial profits – sometimes in just a matter of days.

Historically, when they finally invest, stocks are at or near their highs, the price plunges, and they watch in horror as the money they scrimped, saved, and struggled to accumulate has been decimated.

The terrible losses cab drivers suffered should serve as another warning about how quickly markets can become irrational and deadly. But probably it won’t. There’s something about human nature that makes us ignore the very painful lessons we’ve learned again and again.

Sources: cbsnews.com; npr.org; nytimes.com; wikipedia.com; zerohedge.com

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.