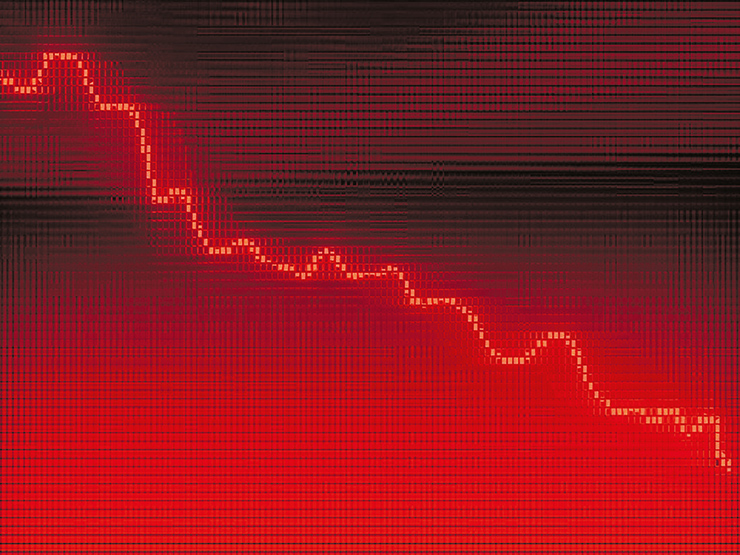

Feb. 3, 2022, is a day Facebook shareholders would love to forget, but they won’t. In fact, at the risk of sounding melodramatic, for them it will live in infamy.

That day, Meta Platforms, as Facebook’s owner is now called, crashed 26.4% in a single session. Although the degree of this collapse is obvious, the magnitude of the selloff becomes even clearer when put into perspective. Just consider the following:

The drop wiped out more than $251 billion of the company’s market value in a single session, making this the worst one day drop any company ever suffered in the history of the stock market. And Facebook didn’t take over the lead in this category by just squeaking into first place. The previous holder of this “distinction” was Apple, by virtue of the one-day loss it suffered back in Sept. 2020. But Facebook’s rout outdid Apple’s drop by a whopping $55 billion. According to The Economic Collapse Blog, this amount is nearly as much as the entire market cap of Disney.

And the fiasco didn’t stop there, as the ripple effects extended to other social media companies including Twitter and Snap, both of which also fell sharply.

In addition, Meta (Facebook) is heavily weighted in the S&P 500 and other popular indexes, and analysts say the crash in Facebook dragged them down as well. For example, the S&P 500 dropped by 2.4% that day -- the biggest drop in nearly a year; the tech-heavy NASDAQ Composite did even worse by shedding 3.7%, its worst showing since Sept. 2020. Even the Dow, which does not include META, didn’t escape the spillover, and it fell by 1.5%.

Facebook had been enjoying rapid growth and The Street expected that to continue. Unfortunately, the party came to an abrupt end -- at least temporarily -- as revenues for the quarter disappointed, and the company projected that going forward growth would continue to slow.

The Bigger Picture

Some analysts suggested that there is a bigger picture here that needs to be considered, and that one concerns not just the performance of a single company, but the strength of the overall market.

One of the arguments for buying stocks is that even if prices go lower, there’s no reason for concern because they always bounce back. This theory has held up surprisingly well for a long time -- essentially since the market rebounded from the financial crisis in 2008.

So does this mean that Facebook shareholders need only be patient and the price of the stock will come back? Not necessarily, because not every story on Wall Street has a happy ending. And even when it does, sometimes there’s a lot more to it than what’s obvious at first glance. Looking back at how markets have performed in the past makes this point very clear.

History Lessons

In November, 1968, the S&P was 853; then the market dropped very sharply. The good news is that it ultimately recovered from that selloff, but there’s bad news, too. The S&P 500 didn’t see 853 again for 25 years. Even worse, inflation was very high during some of those years and eroded the value of the dollar. This means investors actually may have had to wait even longer until they recouped the buying power they had back in 1968.

There are other examples in market history that make the same point. For example, in September 1929, the S&P 500 reached a high of 486. The Great Crash of 1929 followed soon afterward and sent stocks reeling; the S&P 500 also came tumbling down. It eventually got back to its high of 1929, but not until May 1956 -- 27 years later. Subsequently it plunged again, and when taking that into consideration investors actually had to wait 56 years to get their money back -- and this is without factoring in inflation.

Facebook shareholders who were hoping the price would recover quickly were surely disappointed because they didn’t. The shares fell to approximately 241 on Feb. 3, the day of the announcement. Then, after a half-hearted attempt to rally, they continued to decline.

Plenty Of Company

If Facebook shareholders felt miserable, they were not alone, as shares of some other well-known stocks also were zapped recently.

PayPal, for example, recently closed down 24% in its worst-ever trading day after the company provided weak guidance going forward, and noted that “4.5 million illegitimate accounts had joined the platform.”

Starbucks is another company that took it on the chin after earnings fell short of expectations. The company blamed higher than expected costs throughout its supply chain, and said that it anticipates higher inflation for the rest of the year.

Do Facebook’s woes have any implication for the market at large? There appears to be a difference of opinion about this between young, Robinhood-type speculators, who are relative novices in the market, and veterans, who have been around the block a few times and know exactly what a bear market feels like.

Some of those young investors were fortunate enough to have made hefty profits day trading low-priced speculative stocks, options, and dabbling in cryptocurrencies. Apparently, many of them believe that making money in the market is a breeze, and if they lose money there’s no reason to worry because they’ll get by on credit cards. Even in the event of a financial crisis the government will save the day by issuing more stimulus checks. They’ve never experienced the intense and prolonged pressures generated by a bear market.

Their more experienced counterparts, on the other hand, have formed their opinions by going through trial by fire, not while sipping lattes or champagne. They’ve had the unpleasant experience of watching their investments wither and faced the dilemma of having to decide whether to sell what’s left of their portfolios at a steep loss or “rescue” whatever money is still left by risking more money and purchasing more shares at the now lower price. They also don’t believe stimulus checks will continue indefinitely.

Face Forward

How might Facebook’s shares perform in the near term? Opinions vary sharply. One bear is Wedbush tech analyst Dan Ives, who told Yahoo Finance, «They can change their name every month if they want to, but their strategy is ultimately social media and digital advertising. I think there are some dark days ahead for Facebook.»

Even bulls, such as tech analyst Mark Mahaney, are now cautious about the stock price in the near-term. “Shares are probably dead money at this level of growth for at least the next three months,” he said.

Other analysts, however, believe that Facebook is developing products that are so amazing that they have to be seen because words can’t adequately describe them. It should also be noted that Facebook management is considered very bright and capable.

Can Facebook quickly regain its footing and resume its rapid growth or has it entered into a slow growth phase? The answer to this question will affect not only the company’s shareholders, but very likely those of other tech companies too, and to an extent the overall market. Meanwhile, the crash in Facebook is one more example of a market that can get very mean very quickly - and sometimes does.

Investors beware -- just in case the road ahead becomes very rocky.

Sources: bloomberg.com; economiccollapseblog; yahoofinance.com; You Tube: Stoic Investor

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.