Is America sliding toward bankruptcy? A lot of people were asking this question when the US reached its debt limit, the maximum amount of money the Treasury can borrow to pay its bills. This problem is one that millions of people understand from firsthand experience: The bills keep mounting, there’s not enough money to pay them, and people keep falling further behind. This is bad enough when it happens to individuals; when entire countries are in this predicament, it’s much worse.

Not all that long ago, no one questioned America’s solvency or its currency. The expression “As sound as a dollar” came about because the US dollar was prized both at home and around the world. And America’s economy was the envy of the world, as our farms helped keep people well fed and our factories turned out products that made their lives easier.

But we’re living in a different era now. Today America’s debt is spiraling out of control and the dollar possibly in the process of being dethroned as the world’s reserve currency. There is a long list of worrisome economic statistics that can no longer be denied or swept under the rug, and they make very clear America has big time economic woes.

How did we get into this mess? You can be sure this question will be asked repeatedly and analyzed in great depth. A more important one is how do we get out of it.

I Owe, I Owe

If you disagree about the US being in a quagmire check out the following data, which were compiled by The Economic Collapse Blog. Better fasten your seat belt before reading them.

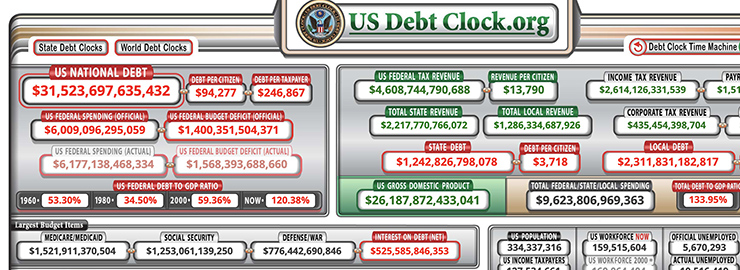

*The US national debt now exceeds $31.5 trillion, and is increasing fast. It’s hard to fathom a number so humongous, so think of it this way. The value of all the goods and services produced in the US last year was $25 trillion. If all of those were used to pay down debt, we’d still be more than $6 trillion in the red.

According to Statista, in 2022 the government paid $724 billion in interest on its debt. If the economy continues on its present trajectory, those interest payments will go much higher because interest rates are increasing and so is debt.

The debt difficulties don’t stop here. Following are other statistics that may surprise you:

State and local governments combined are more than $3 trillion in debt.

Corporate debt tops $12 trillion.

In January 2023, credit card debt reached a record high, and so was the average rate of interest on credit card balances. Zero Hedge called this combination “a catastrophe.” Meanwhile, with layoffs soaring, more people may need to purchase their basics with plastic.

In mid-January 2023, federal and private student loan debt were a combined $1.76 trillion.

In mid-December 2022, auto loans topped $1.5 trillion.

The savings rate is at a historic low and will go lower as people continue to tap into their “rainy day funds.”

And at the end of June 2022, mortgage debt was $11.39 trillion, according to the Federal Reserve of New York.

Will all of this debt possibly be repaid? How? If not, who will take the hit? The government may have to pick up some of the slack.

If the debt ceiling was intended to keep the government from spending money recklessly, it’s not doing a very good job. This may be one of the reasons a group of 43 Democrats want it eliminated entirely.

If their idea sounds extreme, it’s not. The following is from the Treasury website: “Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. Congressional leaders in both parties have recognized that this is necessary.”

Finger Pointing Begins

According to Zero Hedge, President Biden, Senate Democrats, and mainstream media supporters “are lambasting Republicans for their ‘irresponsibility’ in seeking to include spending cuts with an increase in the debt ceiling.”

But former Republican Representative and Presidential candidate Ron Paul, who is also a longtime critic of our fiscal policies, sees things very differently. Paul said, “The irresponsible ones are those who think the government should increase its credit limit without cutting spending.”

While politicians wrestle with this issue, a new poll taken by Rasmussen Reports found that a majority of the public prefers a partial government shutdown to new spending until Congress gets spending under control.

Penny Wise But Dollar Foolish?

Clearly there are problems with the dollar, and if those are not addressed at some point, ordinary people, companies, and other countries could lose confidence in the greenback. And that could open a Pandora’s box of troubles that would be difficult to contain.

In the coming weeks, politicians will discuss the issue of excessive government spending in detail. Whether anything meaningful will emerge from those discussions is a separate issue.

Recipients of government programs and lobbyists will fight tooth and nail to keep big ticket programs intact without cutting a plug nickel. That’s understandable, but it doesn’t change the fact that dollars are being printed so fast that they’re creating high inflation and weakening the currency.

There’s an often-repeated criticism that all our spending is making our lives easier now but mortgaging our future. Well, that’s no longer up to date, because at this point all the interest the government has to pay on its debt and the inflation caused by uncontrolled spending is mortgaging our present as well.

There’s never a good time for debt to skyrocket, and particularly not now, since the economy is weakening rapidly, virtually every day we hear about huge new layoffs, inflation remains high, and interest rates are at the highest in years. No wonder people are worried about America’s future.

Is it wishful thinking to expect that the outcome of discussions in Congress will reassure both the markets and the man and woman on the street?

Sources: www.bankrate.com; www.bloomberg.com; www.cnn.com; www.forbes.com; www.home.treasury.gov; www.lendingtree.com; www.nerdwallet.com; www.statista.com; www.theeconomiccollapseblog.com; www.statista.com; www.zerohedge.com

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.