There are few foods that can compete with ice cream. It offers some relief on stressful days, and is inexpensive and readily available. These are things everyone would agree with.

Years ago, ice cream was a summer treat. When the weather turned colder, sales dropped sharply. But not anymore. These days, it’s eaten around the year; consumers savor its sweet, refreshing taste as a snack, a quick meal, or as an excuse for a family treat at the local ice cream shop.

A Gourmet’s Delight

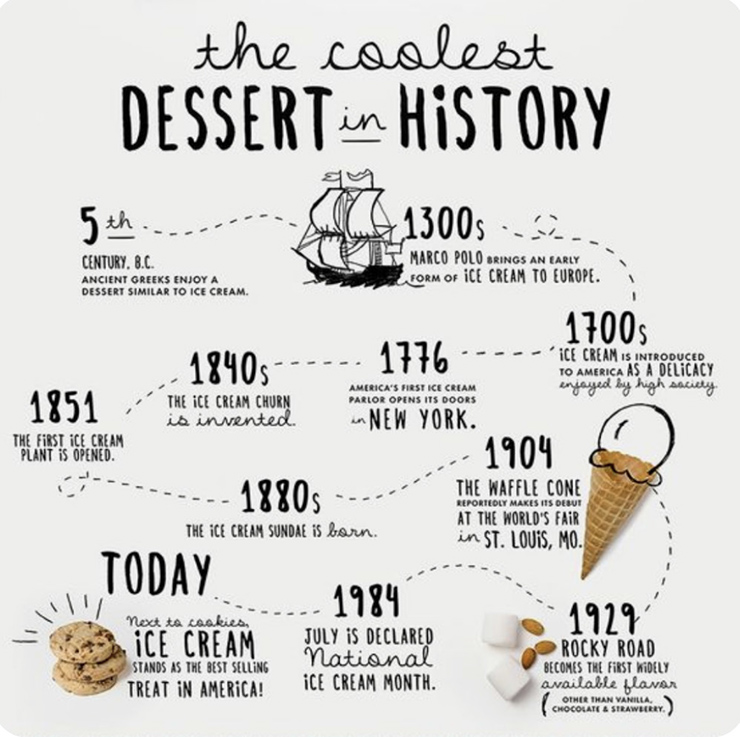

The history of ice cream goes back hundreds of years, if not thousands. British confectionary Philip Lenzi is said to have introduced it in New York in 1774 and word spread quickly across the country. But references to it go back much further than that.

According to Wikipedia, the first mention of ice cream was in England in 1671. Elias Ashmole described the dishes served at a feast for Charles II and included ice cream among them.

Others believe its origins are even older. In 1295, Marco Polo returned to Italy from the Far East with a recipe for a product that closely resembles sherbet. Ice cream is said to have evolved from that in the 16th century. Still others say it can be traced to the Tang Dynasty in China (618 - 907), the ancient Romans, and the ancient Persians.

Whatever its true origins, ice cream really caught on when advances in technology made freezing possible and available to the masses.

Not Your Father’s Ice Cream Anymore

The world used to be happy with just three flavors: vanilla, chocolate, and strawberry. Vanilla was and remains the most popular in almost every country, with chocolate in second place.

But consumer tastes and demands change. Go into any ice cream store and you’ll see dozens of flavors – some very surprising. Is smoked salmon ice cream your favorite or do you prefer corn on the cob ice cream or foie gras? If not, how about pickled mango, horse flesh, or lobster-flavored?

According to the International Dairy Foods Association, US companies produced approximately 1.3 billion gallons of ice cream in 2021, and sales were forecast to grow at a nearly 5% rate in the five following years. In 2022, sales reached an estimated $10.6 billion. They are actually even higher because these numbers don’t include ice cream made in homes (and probably not in small ice cream parlors either). About 40% of Americans eat ice cream at least once a week.

The global ice cream market was $79 billion in 2021 and it was forecast to grow at a 4.2% rate.

Few Pure Plays

The ice cream industry is very competitive. Investors who want to own a piece of it have several options, although very few are pure plays.

Unilever, for example, is the largest ice cream company in the US. Investors, however, who purchase its stock are also buying the world’s largest producer of soap as well as various foods, personal care items, vitamins, and more.

Dairy Queen, another major ice cream maker, also operates a chain of fast food restaurants. Aside from this it is part of Berkshire Hathaway, which own dozens of well-known brands and whose shares trade in the $500,000 range. Nestle, another very large ice cream maker, also makes a variety of chocolate, snacks, prepared foods, milk-based products, pharmaceuticals and much more.

Being Direct

A more direct way of investing in ice cream is opening your own shop. Patrons usually don’t spend too much time in these stores, but in order to draw customers they need modern lighting, a pleasant decor, clean tables, etc. And all of this costs money.

The cost of opening such a store varies but usually begins at at least $50,000 - less when buying used equipment and without making renovations. But this idea will not appeal to all entrepreneurs. Rent and the cost of ingredients are expensive and cannot be avoided. Add electricity, labor, and other essentials and suddenly you are looking at a store that has high overhead.

According to Ice Cream University, a standard ice cream shop has a profit margin of about 25%. This means that in order to earn one dollar profit the store has to sell at least $4 of product. Imagine how much ice cream has to be served just to cover costs. That’s why some stores try to boost sales and profits by selling ice cream cakes and shakes, as well as water and other soft drinks.

Some Cold Hard Facts

Businesses that sound great on paper, such as ice cream, don’t always work out. Anecdotally, one ice cream store opened in front of a bus stop, directly across the street from a major supermarket, within two blocks of a public school and a yeshiva and on a heavily trafficked block. Even better, it was the only such store in the area. Nevertheless, it had difficulty drawing customers, and after struggling for several months, the proprietor had had enough and closed shop.

Even major chains run into problems, and one of these was Friendly’s Ice Cream. The company thrived for many years by offering a tasty product and friendly service to blue-collar customers.

But in 1987, the company had its first-ever decline in profits - a small one, but one that was an obvious warning sign, but it was ignored. Rather than focusing on its successful, traditional strategy, Friendly’s decided to become more upscale. It introduced steak and other higher-priced items, closed some of their restaurants, and tried to give their stores a much “classier” appearance.

These strategies proved disappointing. It also had to deal with labor shortages and rising costs, and its problems grew steadily worse. In one three-year period, the shares plunged from $26/share to just over $2/share.

In 2011, the company could not manage its debt and filed for bankruptcy. Friendly’s continued to downsize and claimed it was gradually getting back on track. Still, in 2020, it filed for bankruptcy again. And then the pandemic began. In other cases, companies have lost business by supporting controversial political agendas.

The ice cream business is as pressured and complicated as any other. In real life, opening an ice cream parlor or investing in a large manufacturer is not any easier than other industries. Entrepreneurs who may have thought otherwise learned that investing and toil go hand in hand.

The stories about people who make a mint in this or in other industries are the exceptions to the rule. Even in today’s modern society, making a living usually comes the old-fashioned way: by the sweat of your brow.

Sources: gitnux.com; ibisworld.com; khanacademy.org; mentalfloss.com; moneyunder30.com; mordorintelligence.com; 10best.com

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.