Here we go again! Fuel stockpiles are down sharply, the price of oil is soaring, and rumors of imminent gasoline shortages are rampant. Will these issues, along with OPEC+ production cuts, lead to a new energy crisis?

What’s going on out there? Weren’t global economies phasing out oil? There’s a good answer to this question, but it won’t make anyone happy.

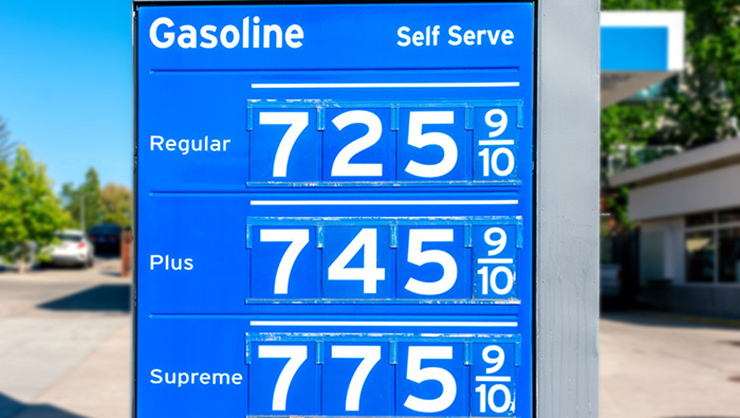

According to CNN, gasoline is now at the highest point in eight months, and motorists should prepare to pay even more because refineries have to close for maintenance. Already, supplies are becoming tight in many states.

The cost of energy is becoming a serious issue again, and there’s no reason to think this will improve in the immediate future. The AAA reports that on August 3, the national average price for a gallon of regular gasoline was $3.80.

Up, Up And Away

Since June, a gallon of gas has increased by more than $0.30. Are this could be just a taste of what’s to come. Analysts are forecasting $5/gallon gas by fall; in a few locations they already top $6/gallon. Meanwhile, weather forecasters predict that this hurricane season could be an exceptionally active one. If a hurricane should make landfall in an oil-producing area, gasoline production would be interrupted.

Market commentator Epic Economist reports that both domestic and international producers are slashing production due to economic and political factors. At the same time, demand remains strong, and gasoline inventories are declining.

We’re seeing the immediate result of higher demand coupled with lower supply at the gas pump. The price of oil is the most important component in fuel prices – and in July, the price of a barrel jumped by more than $10/barrel.

“Gas Prices Up: Sticker Shock Hits Pump As Heat Wave, Oil Prices Push Cost to 8 Month High For Gasoline And Other Refined Products,” read a headline in USA Today. An even greater concern is whether the higher price is just a “blip” or the beginning of an upward trend that will continue to affect markets and the economy.

According to Epic Economist, lower gasoline inventories are “in large part the result of production cuts introduced by OPEC+ and alliances of the world’s largest producers.” In addition to slashing production by 1.5 million barrels in May, OPEC+ announced an even larger production cut in July.

Meanwhile, sanctions on major exporting countries including Iran, Venezuela and Russia have also impacted the global supply and helped push prices higher according to JP Morgan’s Head of Global Commodity Strategy. Russia is the world’s third largest producer of crude oil, behind America and Saudi Arabia; and it’s the second largest exporter after the Saudis.

AAA analyst Robert Sinclair calculates that so far this year, four million barrels/day were removed from global markets because of OPEC’s production cuts. Sinclair says these represent nearly four percent of the world’s daily production, which is some 102 million barrels.

Get Ready

Markets are bracing for the possibility of still more cuts. On August 3, the Saudi Ministry of Energy said that its voluntary production cuts would be extended at least through September; they also indicated even deeper cuts may be needed to reach their goal of $100/barrel oil. OPEC+ currently produces approximately 40% of the world’s crude.

Oil was recently trading above $82/barrel, the highest price since Feb. 2022. According to the International Energy Agency, global oil demand is expected to continue to increase and supplies will get tighter. This means the world will have to deal with a supply shortfall of at least 1.8 million barrels a day.

In this case numbers don’t tell the whole story. A shortfall of 1.8 million barrels a day may not sound very significant until considered from a different perspective. After the oil embargo in 1973, the US had a shortfall of 5%, which some people shrugged off. After all, if people would only make minor adjustments to their lifestyles – lower their thermostats by one degree, make washes only when there was a full load, drive a bit slower, etc. – the shortfall could be managed easily. In addition, back then, oil from the Prudhoe Bay Oil Field, the largest in North America, was scheduled to come online soon. Even so, oil prices in the US more than tripled!

No Prudhoe Bay Now

What would happen if political or natural events lead to a 5% shortfall today? Unfortunately, America doesn’t have a gigantic oil field about to go into production, so oil prices would spike and soon afterward the price at the pump would spike. Doesn’t this sound a lot like the scenario unfolding right now?

Even the weather is driving energy prices higher. The intense heat this summer is increasing demand for air conditioning, which in turn is increasing demand for energy. In addition, many refineries have to reduce production during high heat for safety reasons. These and related factors could also pressure prices.

Inflation And Interest Rates

If oil prices do in fact remain high, they could impact the next inflation report. And if inflation does increase, the Fed may feel a need to keep raising interest rates. Neither Wall Street or banks, which are already hurting, would be happy about that.

In any case, America’s strategic supply reserves are currently the lowest they’ve been in years. If there’s a prolonged disruption of supply – for whatever reason – the US may be unprepared to deal with it.

What all this means is that the elements of a serious energy crisis may be falling into place. Completely unpredictable events have been developing in the last few years and no one can say with certainty they will not affect energy. Let’s hope prices settle down quickly, and all the worry and hand-wringing are for naught.

Sources: bloomberg.com; cnn.com; gasprices.aaa.com; usatoday.com; zerohedge.com; YouTube: Epic Economist: Gas Prices Will Skyrocket In America

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.