Earlier this month, in an attempt to out-progressive all of her Democratic presidential candidates, Senator Elizabeth Warren rolled out her tuition forgiveness plan, which can eliminate up to $50,000 of student loan debt per person. I promise. I’m only going to spend a short time explaining why this is a dumb idea, and then get into actual good ideas that Republicans can use to combat this.

Make no mistake about it. Completely forgiving student loan debt is a horrendous idea. Firstly, it removes the burden of responsibility that individuals took on in order to attend universities to begin with. Nobody forced students to take out college loans – they were taken out voluntarily. Let’s not forget that the loans aren’t being forgiven – they are being paid for by other people. A so-called “Ultra-Millionaire Tax” will be levied on wealthy families (a tax, by the way, on money that has already been taxed).

This proposal also penalizes those who have already paid down student loans, or those who made the decision not to attend college in the first place, or simply to attend cheaper schools so as not to have the student loan debt in the future. Personally, I chose to get my master’s degree from a CUNY school instead of a private school. Had I known that I wouldn’t have had to pay the money back for the education, I would have gone to one of the private schools to which I was accepted at quite literally triple the price of the CUNY school.

And, of course, there is this little matter of it’s not fixing the problem! That’s right! If this goes into effect, it doesn’t prevent future generations from taking out the same student loan debt. They will just go back to taking out loans for private four-year colleges. This bill only deals with current student debt. In fact, it can potentially give future students the belief that the federal government will just come and pay off any incurred loan debt in the future. If they fixed it once, they could fix it again! Of course, Warren does want to make all public universities free, moving forward, and she somehow doesn’t have a plan to pay for it other than that the cost is split between state and federal government. There is currently no funding mechanism listed on her site.

So to recap, this proposal rewards students who made bad decisions and aren’t able to live up to their promises. It punishes responsible students who paid off their debt or chose not to go into debt to begin with. It’s to be funded by (Bernie Voice) the millionaires and billionaires who must pay their fair share (end Bernie Voice), who have already paid taxes on this money sitting in the bank. And in the end, it doesn’t solve the problem anyway.

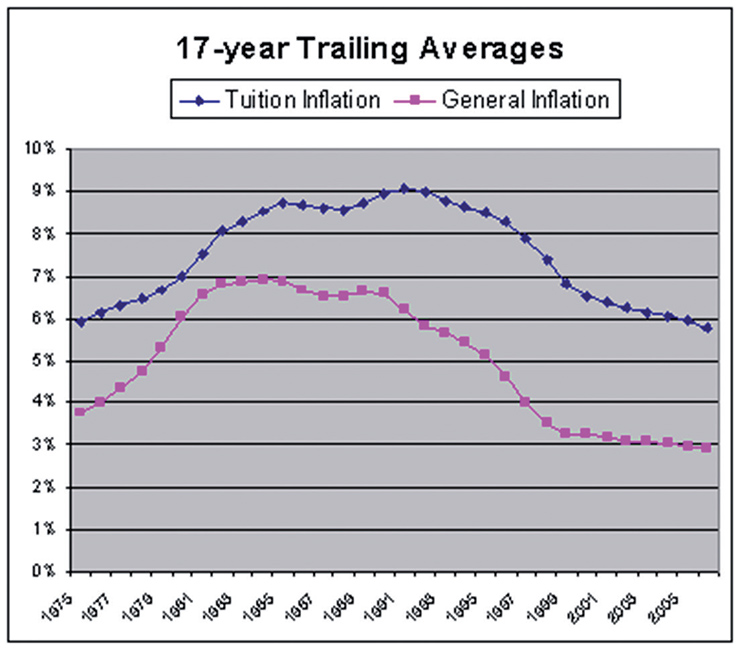

Okay, so we discussed why this is a terrible idea. Before we get onto the better ways to look at the cost of higher education, it’s important to understand exactly with what we, as a nation, are dealing. According to the Bureau of Labor Statistics, over any 17-year period, inflation rates on higher education tuition have consistently been double the rate of general inflation rates. For example, again according the Bureau of Labor Statistics, the cost of milk is 25.51% higher in 2019 than it did in 2002. That would mean that the inflation rate on tuition over the same amount of time could be up to 50%.

Purdue University has recognized this. So for a good idea on how to battle student loan debt, I direct you to Purdue University President, former Indiana governor, Mitch Daniels. Daniels, who took over the university in 2012, noticed that in the years leading up to his hire, despite the operating costs of the school not going up, tuition was going up. He discovered that Purdue raised tuition, not only based on cost, but based on the market. If another university raised its tuition, Purdue would do so as well, lest potential students and parents determine that the Purdue education was less valuable than another similar university. It’s literally the opposite of how markets are supposed to work. Markets are supposed to keep costs down by creating competition. However, in higher education, competition somehow drives the price up.

His solution? A tuition freeze. Purdue is in the middle of an eight-year tuition freeze. Tuition has not risen since the 2013-14 school year. And enrollment is up seven percent since 2013. Clearly, the policy didn’t drive away students, as was the fear. Daniels and Purdue used basic market strategy: Offer the best (or similar) product at the best price. (Hear that, yeshivos?)

But Daniels did not stop there. Purdue instituted an income-sharing agreement (ISA). In this model, there is no up-front cost for college. Students only pay for school once they graduate and get a job. Students pay for their education based on income. Higher earners pay a higher percentage of their salary. However, higher earners also end up paying their loan back faster. Students are not required to pay for loans if they are unemployed. The payment is only collected while the graduate is working. (Dropouts must pay back the tuition in full.) This method promotes fields with a higher income potential, and allows students to pay for a degree with a level of flexibility not offered by any student loan program out there.

This is a model that could change the way we think about tuition and higher education on a national level. It rewards positive decision-making, and doesn’t crush the unemployed. Daniels believes that colleges are there to provide a way for its students to make a livelihood after graduation, and if they aren’t doing that, they aren’t doing their job. This model bets on the students and forces the universities to do their job.

Izzo Zwiren works in healthcare administration, constantly concerning himself with the state of healthcare politics. The topic of healthcare has led Izzo to become passionate about a variety of political issues affecting our country today. Aside from politics, Izzo is a fan of trivia, stand-up comedy, and the New York Giants. Izzo lives on Long Island with his wife and two adorable, hilarious daughters.