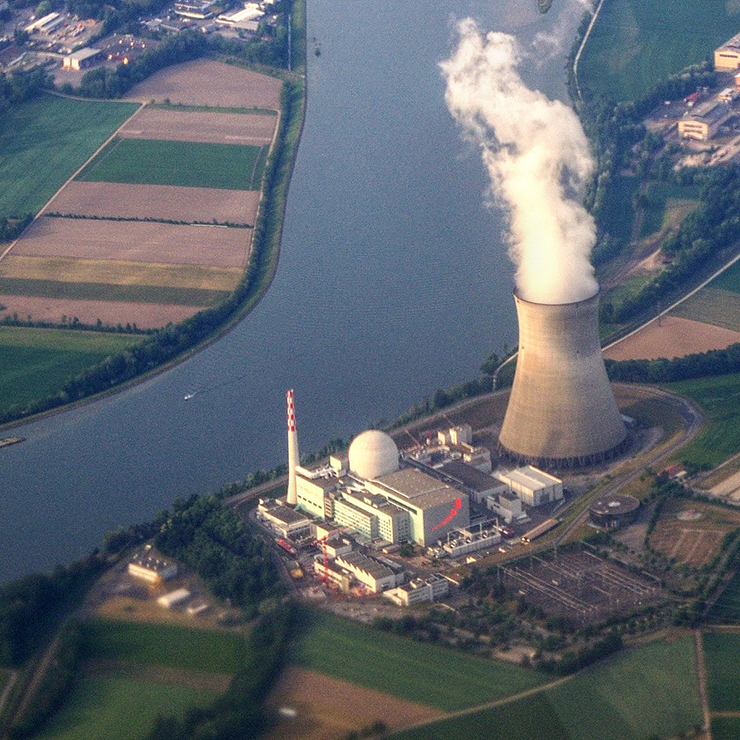

Back in 1958, a lot of people were delighted when the first US commercial nuclear power plant was built. No wonder. The plant offered the promise of reliable, clean, safe, and very inexpensive power. Well, we all know that didn’t quite live up to expectations.

For one, nuclear power was not nearly as inexpensive as people had anticipated. More important, it also wasn’t as safe.

The first major accident in the US occurred in 1979 when there was a partial meltdown of Unit 2 at the Three Mile Island reactor in Pennsylvania. TV news coverage brought the dangers of this technology into everyone’s living room, and to say the public was alarmed is a huge understatement.

An even worse calamity took place at 1986 when a reactor at the nuclear power plant at Chernobyl, then part of the USSR, melted down. “It went out of control during a test at low-power, leading to an explosion and fire that demolished the reactor building and released large amounts of radiation into the atmosphere,” according to the International Atomic Energy Agency. And in 2011, there was another nuclear catastrophe, this one at the Fukushima Daichi plant in Northern Japan that by some measures was as bad or even worse than the meltdown at Chernobyl.

A lot has happened to power over these past decades. The world has experienced several energy crises, soaring prices, an oil crash and much more. More recently, after years of unseasonably warm temperatures, the idea that the world was warming because fossil fuels were trapping heat attracted many adherents. This deterred the use of and exploration of oil and gas.

According to a UN report, “Fossil fuels – coal, oil and gas – are by far the largest contributor to global climate change, accounting for over 75 percent of global greenhouse gas emissions and nearly 90 percent of all carbon dioxide emissions. As greenhouse gas emissions blanket the Earth, they trap the sun’s heat, thereby creating a greenhouse effect.”

Where We Stand Now

Now there is a major tug of war over the future of energy between those who see nothing wrong with using fossil fuels, those alarmed by increasing greenhouse gasses, some who want increased use of nuclear power, and others terrified at that prospect. The winner, at least for the moment, is increased use of nuclear power.

According to a report by Bloomberg, cited by Business Insider, “Hedge funds are pouring money into uranium stocks as they bet on a nuclear-powered future. Hedge funds are laying bets on uranium, a critical element in nuclear energy.”

The price of uranium has increased by 125% since the end of 2020. The Wall Street Journal reported that uranium prices reached a 16-year high early in January after one of the world’s largest producers said it is unlikely to reach its 2024 production guidance, putting additional pressure on already tight supplies.

According to FX Empire, “Uranium’s third bull market is off to a red-hot start in 2024 with spot prices skyrocketing above $106 per pound…That›s more than a 100% increase from their 2023 low. It is also a whopping gain of over 350% from their 2020 low.”

Revival Of The Dead

The developments now unfolding in uranium is the stock market version of resurrection of the dead. After the horrible meltdown in Fukushima, nuclear power had become a pariah among many investors, and utilities and ordinary people shunned it. According to Wikipedia, countries that have no nuclear plants and have restricted new plant construction include Australia, Austria, Denmark, Greece, Ireland, Italy, Norway, and Serbia. Poland stopped the construction of a plant. And as of April 2023, Germany is no longer producing any electricity from its nuclear power plants.

But other countries have picked up the slack, and nuclear power has gradually moved back into favor. And this is why there has been growing demand for uranium, and why shares of many miners and related companies are moving higher. According to Oilprice.com, “The comeback of nuclear power is expected to drive a record-high electricity generation in 2025,” the International Energy Agency said.

It’s predicted that nuclear-generated power will increase by nearly 3% yearly through 2026 – this despite the fact that some countries either already have or are in the process of phasing out their nuclear power plants.

But others are moving toward this technology. France, for example, is restarting plants that were closed for maintenance, and new reactors are starting up in China, India, South Korea, and Europe according to the IEA.

Clean And Green

What has brought about this drastic change? First, many countries have set an objective to become “net zero” – not adding carbon into the atmosphere because of concerns about global warming. And the International Energy Agency says in order to do that “global nuclear generation capacity must double from 2020 levels by 2050.

Increased use of nuclear energy also offers western economies the added benefit of reducing their need for Russian oil and gas. True, Russia has approximately 8% of the world’s uranium reserves. But those countries “hope to get around this by developing new supply sources,” according to Zero Hedge. Meanwhile, there’s increasing demand for nuclear power in Asia and Africa.

This trend has created optimism about the industry and some investments related to it. “(Some uranium) equities could see dramatic upside – 50%, 100%, possibly more,” Terra Capital’s Matthew Langsford told Bloomberg recently.

Langsford has been adding to positions in Denison Mines Corp and NexGen Energy. Denison is a Canadian company that explores, develops, and produces uranium. NexGen, another Canadian company, is exploring a new Canadian mine that some believe has potential of producing a quarter of the world’s supply of uranium. If this proves correct, NexGen would be “very important for the nuclear industry in the 2030s, which could end up being the golden age of nuclear power,” Langsford added.

Reuters reported that demand for uranium reactors may increase by 28% by 2030. And in the following decade this number might double “as governments accelerate their nuclear energy capacities to meet zero-carbon targets.”

Investors can follow uranium miners on NASDAQ or other exchanges. Some are high-potential companies, but others are exceptionally risky. Speculators have been trying their luck with uranium shares certainly since the 1950s. The lucky ones made profits and had fun; many more ended up with expensive wallpaper. The bottom line: Always consult your advisor.

Sources: cnbc.com; eia.gov; fxempire.com; iaea.gov; nih.gov; nc.gov; oilprice.com; un.org; wikipedia.org; wsj.com; yahoofinance.com; zerohedge.com

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.