Many people invest in the market for the potential profit, dividends, excitement, and, just possibly, the possibility they will hit a moon shot. At the same time, safety is also important to them and they want to stay far away from the scandals and shocking scams that have been associated with some penny stocks. How should they proceed? Many opt for an obvious answer: buying shares in very large companies with solid reputations.

Unfortunately, a surprisingly high number of these have backfired and proved to be as corrupt, phony, and deceitful as the scams conceived in boiler rooms. There are virtually countless examples; several of these follow below.

They Purchased What?

In 1994, a press release making the rounds on the Internet raised a lot of eyebrows. That’s because it reported that Microsoft had purchased the Catholic Church. The press release clearly was written by a professional. It even had a quote from Bill Gates, head of the company. He explained that religion was a growing market, and that the combined resources of the Catholic Church and Microsoft would allow them to make religion more fun and accessible for many more people. The release added that following the purchase, Microsoft would own the rights to the Bible, and that various religious rituals would be available online.

It’s obvious now that this release was a hoax, but at the time it seemed very real and many people were suckered. It’s not clear how many people (if any) purchased (or sold) Microsoft stock. But as an indication of how many people believed this story, in December of that year Microsoft felt compelled to issue a real press release denying it had purchased the Church.

All That Glitters....

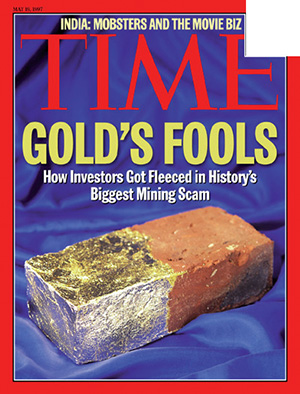

While a lot of people were taken in by the alleged Microsoft acquisition, even more were suckered by the Bre-X Gold Mining fiasco, which became one of the biggest frauds in the history of the world and almost certainly the biggest mining scam of all time.

Back in 1995, Bre-X Gold was a tiny Canadian gold exploration company, one of many hundreds that had dreams of finding a giant deposit of gold with only a very small budget. But Bre-X broke away from the herd and shocked the world, claiming it had discovered a tremendous deposit of gold in Indonesia.

Literally overnight Bre-X become the center of conversation at parties, the headline story on news shows, and all the rage of Wall Street. The company’s press releases indicated that its discovery was so humongous that some analysts wondered aloud whether the market could absorb all of that gold without driving the price down.

Bre-X’s stock responded as one would imagine; the price soared from just a few cents per share to well over $50. And as the company continued releasing more information, shareholders were ecstatic; other investors could not forgive themselves for missing out on the stock of a lifetime.

There was just one problem that kept this from being a perfect picture: Independent geologists who tested the exploration site found very different results than the company had. There was only a trace of gold there, and absolutely nothing commercial. In other words, the entire story was a fake, fraud, phony, an outright lie that might have been funny had not so many investors lost such a great deal of money and the reputation of many analysts not been tarnished so badly.

Many people were badly burned by the Bre-X fiasco, ranging from the very small investor who trashed the family budget just to get a tiny piece of the action, all the way up to very powerful players and well-known Wall St. firms who, even though they bought stock at high prices, were certain they would make terrific profits.

When shareholders learned the truth, most growled, cursed, and screamed. But a few took their fury a step further. The geologist whose report started the whole sensation was reportedly beaten. Then he was taken for a “ride” in a helicopter over some of the thickest rain forests in Indonesia and in a terrible “accident” fell out of the helicopter while it was 500 feet in the air.

The entire Bre-X story was a very sad one, and everyone involved actively and even passively became a loser. Billions of Canadian dollars were lost, and the company was forced into bankruptcy. Almost no money was recovered for the shareholders who were so badly misled. The only small good that came out of this story was that tougher legislation was enacted vis-a-vis reports written by professional geologists. While it may be a little more difficult to pull off a similar-type scam today, almost certainly it could be done again because, as Shakespeare wrote, people still want to believe that “unicorns may be betrayed by trees.” People have big dreams, and some fraudsters are specialists in taking advantage of this.

From Wall Street With Fear

Who could have imagined that problems with the Wall St. firm Lehman Brothers would quickly mushroom into a terrible drop in stock prices all around the world? Probably no one, and that’s what made this even more shocking.

Like many other firms back in 2008, investment banker Lehman Bros. became involved in mortgages, but with one difference: it did so in such a big way that, in the words of Wikipedia, “it had effectively become a real estate hedge fund disguised as an investment bank.” When the subprime mortgage crisis broke, “it was exceptionally vulnerable to any downturn in real estate values.” And the nightmare scenario for Lehman became a reality.

Lehman was forced to file for Chapter XI on September 15, 2008; it was then and still is the largest bankruptcy in US history. This caused a 4.5% drop in the Dow Jones Industrials, the largest one-day plunge since the 9/11 attacks, and also triggered further sharp declines on Wall Street and in markets overseas. It also accelerated the decline of already shaky economies.

It didn’t take long for Congress to hold hearings about the turmoil that was unleashed on the financial markets and Lehman executives were grilled. Rep. Henry Waxman, a Democrat from California, told one of them, “Your company is now bankrupt, our economy is in crisis, but you get to keep $480 million. I have a very basic question for you: Is this fair?”

The executives questioned tried to justify their high salaries, but that was one tough job, especially since they had received huge pay and bonuses over the prior eight years. The CEO had pocketed a half million in cash just before the bankruptcy, and more importantly, the salaries of top executives rose significantly shortly before the bankruptcy.

It was reported that Lehman Bros. was the greatest victim of the financial crisis. Technically that was true, but in real life the stunned shareholders who watched in horror as their shares became worthless overnight were really the sorriest victims.

The Deepwater Horizon Oil Spill

On April 20, 2010, the BP-owned Deepwater Horizon oil rig exploded off the Louisiana coast. This well was a big producer and, oil, continuing to flow from the well, poured into the Gulf of Mexico. Within hours a massive oil slick covered 600 sq. miles of the Gulf of Mexico and reached the US coast.

BP, one of the major oil companies, had a good batting average in finding oil, but as far as environmental matters were concerned that was a story. The explosion created an environmental catastrophe of unprecedented proportions, as it was the worst in the history of the petroleum history. At least 210 million gallons of oil poured into the sea, as did an additional 1.8 million gallons of chemical dispersants, polluting the water, the US coast, and the sea floor. Even worse, 11 people were killed.

As one would imagine in an environmental disaster of this magnitude, there were all kinds of rumors. For example, after BP said the well had been capped and the oil flow from the well contained, one oil analyst differed, saying oil was continuing to flow into the Gulf (this analyst passed away from a heart attack soon afterward). For its part, BP said the oil disaster was “good for the Gulf.”

What was indisputable was the terrible damage the oil spill (and dispersants) created: all kinds of fish, sea turtles, marine mammals, birds, and other species died or became ill. Many people who took sick blamed their problems on inhaling the fumes from the oil and chemicals in the Gulf.

In July 2015, BP agreed to pay a $20 billion settlement over 15 years. An area 20 times the size of Manhattan still remains polluted.

Immediately after the Deepwater rig exploded, shares of BP lost 55% of their value and the company’s bonds crashed. The company was also forced to eliminate the dividend, sending shock waves throughout Britain, where the company is based, as BP accounted for one of every six pounds in dividends paid to pension and other retirement funds. In addition, the company was forced to shed more than $75 billion in assets to pay for unprecedented government fines, private damage claims, and legal expenses.

The bottom line: When you invest in the market there is no such thing as being 100% safe; there is always some risk, even with the biggest, best known, and longest-established firms. Supplement the recommendations you get with your own due diligence. And then reach for your Tehillim!

Sources: adn.com yahoofinance.com; you tube: top 10 biggest corporate scandals

By Gerald Harris

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.