’They’ve been talking about this for years and are still singing the same tune. Even if you disagree you have to give them credit for never giving up.

What “they” are still singing about is silver, an occasional market darling that has had a few ups and downs over the years, but for the most part has long been out of favor and going nowhere fast. Is this about to change? Maybe. Then again, they’ve been singing that tune, too.

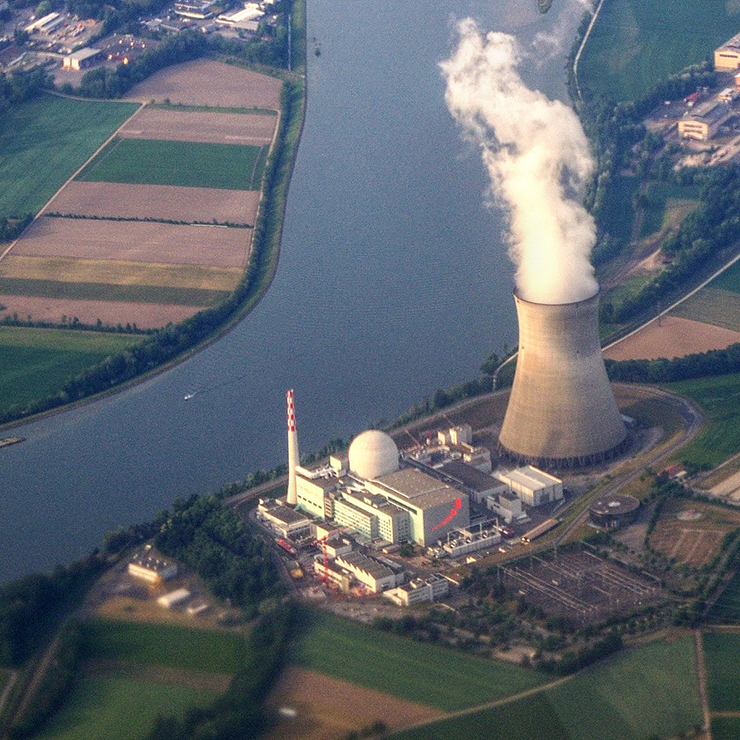

Silver is called the poor man’s gold. It’s a semi-precious metal used in jewelry, industry, and investments. The Silver Institute says it is an essential component needed “in applications from electrical switches and solar panels to chemical-producing catalysts… Its unique properties make it nearly impossible to substitute and it’s used in a wide range of applications. Almost every computer, mobile phone, automobile, and appliance contains silver.”

All of this must be very reassuring for battered bulls. We’ve also heard that the supply of silver keeps declining and that silver is being taken out of the market by hoarders, collectors, investors, and speculators. All of this is true, but for some reason, the price of silver doesn’t reflect this.

Essentially Flat

From the beginning of 2023 through late August, silver has been a less than stellar performer; its price is essentially flat as it trades at just over $24/ounce. By comparison, gold has gained a modest four percent during this time.

Silver has had a few decent rallies over the years, but only two could be called spectacular. The first began in the early 1970s, lasting through the rest of that decade. At that time, the price was less than $2/ounce and the Hunt Brothers (Nelson Bunker and William Herbert), members of one of the then richest families in the world, began buying heavily. By early 1979, the price had increased to $6/ounce. And later that year and into 1980, the price really took off, reaching $48.70/ounce.

Then COMEX suddenly changed the rules for trading silver on margin and the price crashed. More recently, silver rallied sharply in 2011 (along with gold), very nearly tying its all-time high. But since then, rallies have been fewer and not as sharp.

Undervalued Or Outdated?

So is silver undervalued and a good buy? Or will it continue to take a back seat to more dramatic vehicles? The answer depends upon whom you ask, but several factors may reassure bulls.

For one, as has been pointed out by investor Jim Rogers, silver is the only commodity trading at less than half the price it was 43 years ago. This suggests that whatever excesses there once may have been have long been wrung out of the price.

In addition, one of the most powerful players on The Street owns a humongous position in silver bullion. According to investment strategist Dane Klocke, JP Morgan Chase owns at least 600 million ounces directly (and controls more indirectly). This is believed to be the largest hoard of this metal in the world. Interestingly, the bank accumulated all of this at an estimated average price of just $20/ounce, an amazing feat considering the large stash it owns.

Moreover, silver remains very popular with the American public both as a collectible and an investment. Gold IRA Guide conducted a survey that found more Americans own silver than gold. Of 1,500 respondents, 11.6 percent said they own silver, which is slightly higher than the 10.8 percent who replied they own gold.

The US Mint, which produces and sells newly minted silver (and gold) coins, frequently reports that it can’t keep up with the demand for silver coins. According to World Silver Survey 2023, silver bar and coin demand worldwide spiked by 22% in 2022 to a new high of 332.9 million ounces.

Another bullish factor is that a growing number of states have made it legal to use gold and silver as money. As of March 2023, 11 states have already passed such legislation. This increases to 23 the total number of states that have either already recognized gold and silver as money or that have introduced legislation to do so.

By Comparison…

One way financial experts try to determine whether silver is fairly priced is by comparing its price to that of gold. Historically this ratio has varied sharply.

According to Investopedia, for much of the 20th century the ratio was 47:1. But in the 21st century, the range was mostly between 50:1 and 70:1. In 2018 the ratio reached a high of 105:1, while at the other end of the spectrum the lowest level was 35:1 in 2011. Currently, the ratio is approximately 83:1, which means that it takes approximately 83 ounces of silver to purchase one ounce of gold.

These numbers are not compiled just for trivia, but are of importance to analysts and investors. “When the spread gets this wide, silver doesn’t just outperform gold,” notes SchiffGold.com. “It goes on a massive run in a short period of time. Since January 2000, this has happened four times and the snapbacks were swift and strong.”

A Shiny Future?

Although silver has been languishing, some experts believe the long-term trends towards a supply shortage in the making. According to investment firm Schiff Gold, silver demand set records in every category in 2022. At the same time, falling mine output resulted in a 237.7-million-ounce deficit in 2022, the second annual deficit in a row. The Silver Institute noted that the combined deficits of the last two years have more than offset the surpluses of the previous 11 years.

Moreover, demand for solar panels is expected to grow exponentially going forward, and each panel contains silver. By 2050, it’s expected that solar panel production will use approximately 85% - 90% of the current global silver reserves.

“At some point, investors will have to reckon with the shrinking supply of silver coupled with rising demand, along with the Fed’s inability to bring inflation back to its 2% target. When that happens, the price of silver will likely take off,” concludes Schiff. Calculations like these have prompted one analyst to call the current silver price “inexcusably low.”

So the bulls have reason to cheer. But after years of decline and disappointment, they probably want tangible evidence that the price of silver has finally bottomed out. We’ll just have to wait and see if they get what they’re waiting for.

Sources: coinworld.com; daneklocke.meedium.com; firstnationalbullion.com; investopedia.com; learn.apmex.com; mintstategold.com; silverseek.com; thedailyguardian.com; worldpopulationreview.com; zerohedge.com

Gerald Harris is a financial and feature writer. Gerald can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.