If you are fortunate enough to have a family vacation home, you know the emotional value it holds for every member of your family. Many cherished family memories are rooted in a special place, which makes it important for current and future generations to preserve it properly.

A recent Wall Street Journal article explored the use of trusts to preserve a family vacation home. A trust is often a good choice when the current owners — parents or grandparents — are concerned that joint ownership could lead to disagreements or that maintenance costs may prove too great for the next generation to manage.

Instead of dividing ownership, you can establish a trust to hold title of the property and fund an endowment to handle maintenance expenses. In addition, to avoid paying custodial fees to the trust, you can set up a limited liability company to hold the endowment within the trust.

Once the LLC is registered in the state where the vacation property is located and the trust is created, the next step is to draw up a legal operating agreement that specifies when the property title and endowment would pass into the trust, usually upon the current owner’s death.

The operating agreement would also detail how the property is to be used and could grant each member of the next generation the right to equal access to the property. This is usually preferable to granting equal shares in a property since it prevents any one shareholder from cashing out his or her share and jeopardizing the use of the property by future generations.

As the Wall Street Journal article noted, it is usually preferable to have succeeding generations designate a property manager from within the family to make the key administrative decisions and coordinate the use of the property so it is shared equitably.

Using a trust can help guarantee that a beloved vacation home is preserved for generations to come, as well as preserve the family harmony that the home has played such a key role in developing.

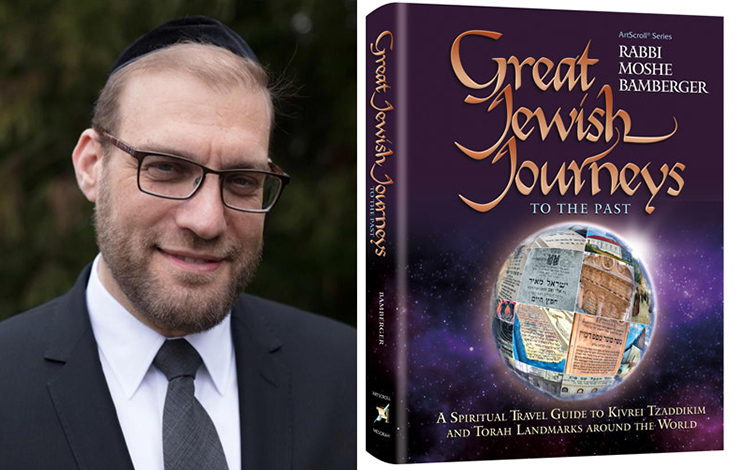

Monet Binder, Esq., has her practice in Queens, dedicated to protecting families, their legacies, and values. All halachic documents are approved by the Bais Havaad Halacha Center in Lakewood, under the direction of Rabbi Dovid Grossman and the guidance of Harav Shmuel Kaminetsky, shlita, as well as other leading halachic authorities. To learn more about how a power of attorney can help you, you can send her an email at This email address is being protected from spambots. You need JavaScript enabled to view it. or call 718-514-7575.