In most cases, from the most sophisticated established business-people with the highest net worth to those just starting in the workforce and growing young families, you very likely do not know how to evaluate estimates when shopping for an estate plan.

Shopping for an estate plan based on getting the lowest cost plan possible is often the fastest path to leaving your family with an empty set of documents that won’t work for your family when they need it.

Unfortunately, we see the negative effects of cheap estate planning when family members come to us during a time of grief with a fancy binder that sat on the shelf for years sending out signals of false security, full of out-of-date estate planning documents, and find themselves stuck in what could have been an unnecessary court process, or even conflict when that’s exactly what their loved one thought they had paid someone to avoid and handle for them.

Here are four reasons why shopping for the cheapest estate plan will likely not work for your family… and could leave them with a big mess instead.

- The least expensive plan isn’t worth the paper it’s written on once you’ve left the attorney’s office -- your life changes, the law changes, and your assets change over time. Your plan needs to prepare for and keep up with those changes. And the truth is, a lawyer can’t afford to provide anything more than documents that won’t get updated or prepare for various circumstances when you only pay a few hundred dollars for a plan. That business model doesn’t work for the lawyer and won’t work for you. An attorney who has built a practice specifically to serve your family and their best interests cannot make a living selling $399 (or even $1,500 or $2,000) Wills, Trusts, or estate plans.

- You get what you pay for. Also, working with a lawyer who focuses on “the best documents” at the “lowest price” or doesn’t charge enough for their services cannot provide more than standardized form documents.

It’s your family that will pay the price. Traditional law firms usually use generic forms and documents. These are called “Trust mills” which are firms that draft plans but don’t ensure assets are owned correctly or stay up to date over time. You might think that’s malpractice, but it’s not. It’s common practice, leaving your family at risk if and when something happens to you!

These days, especially with the rise of AI, template form documents are free for anyone to use, which makes it difficult to know how those documents are handled when it comes to protecting the people you love.

Also, shopping around for the least expensive plan may get you the cheapest documents, but those documents won’t be there to guide the people you love when they need someone to turn to in a crisis or grief. We will be.

- An estate plan isn’t a set-it-and-forget-it kind of thing; it needs to stay updated with changes in your life, the law, and particularly your assets.

There’s currently more than $58 billion of lost property held in departments of unclaimed property across the United States. Assets often land there when someone dies or becomes incapacitated, and their family loses them because they weren’t tracked well during life. And that’s just one way your family loses out if you’ve shopped around for the cheapest estate plan rather than having a plan that works for the people you love.

Is Something Better Than Nothing?

Sometimes, having something in place is better than nothing, but this is not one of those cases. In this case, having a “something” plan leaves your family holding the expensive, or even empty bag, when it’s too late for them and you to do anything about it. It’s risky to leave your loved ones with a set of documents you aren’t sure are going to work, and our guess is that you love them too much for that.

Don’t waste your time shopping around town for the cheapest plan possible. You don’t want a cheap plan; you want the plan that will work for the people you love when they need it.

If you already have an estate plan in place that you may have bought based on price, and are concerned you may have gotten a set of documents that won’t serve your family when they need it most, call us and ask about our 50-point assessment. Contact us at 718.514.7575 to schedule OR email This email address is being protected from spambots. You need JavaScript enabled to view it. to get on our calendar. We begin our planning process with a Family Estate Planning Session, during which you’ll not only become more financially organized than ever before, you’ll finally be able to make informed, educated choices about the right plan for your family based on your unique family dynamics and your assets, instead of just shopping around for an estate plan based on price.

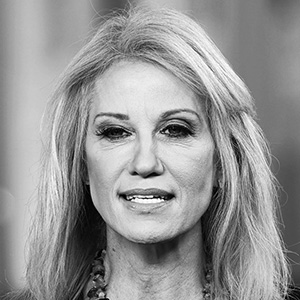

Monet Binder, Esq., has her practice in Queens, dedicated to protecting families, their legacies, and values. All halachic documents are approved by the Bais Havaad Halacha Center in Lakewood, under the direction of Rabbi Dovid Grossman and the guidance of Harav Shmuel Kaminetsky, shlita, as well as other leading halachic authorities. To learn more about how a power of attorney can help you, you can send her an email at This email address is being protected from spambots. You need JavaScript enabled to view it. or call 718-514-7575.